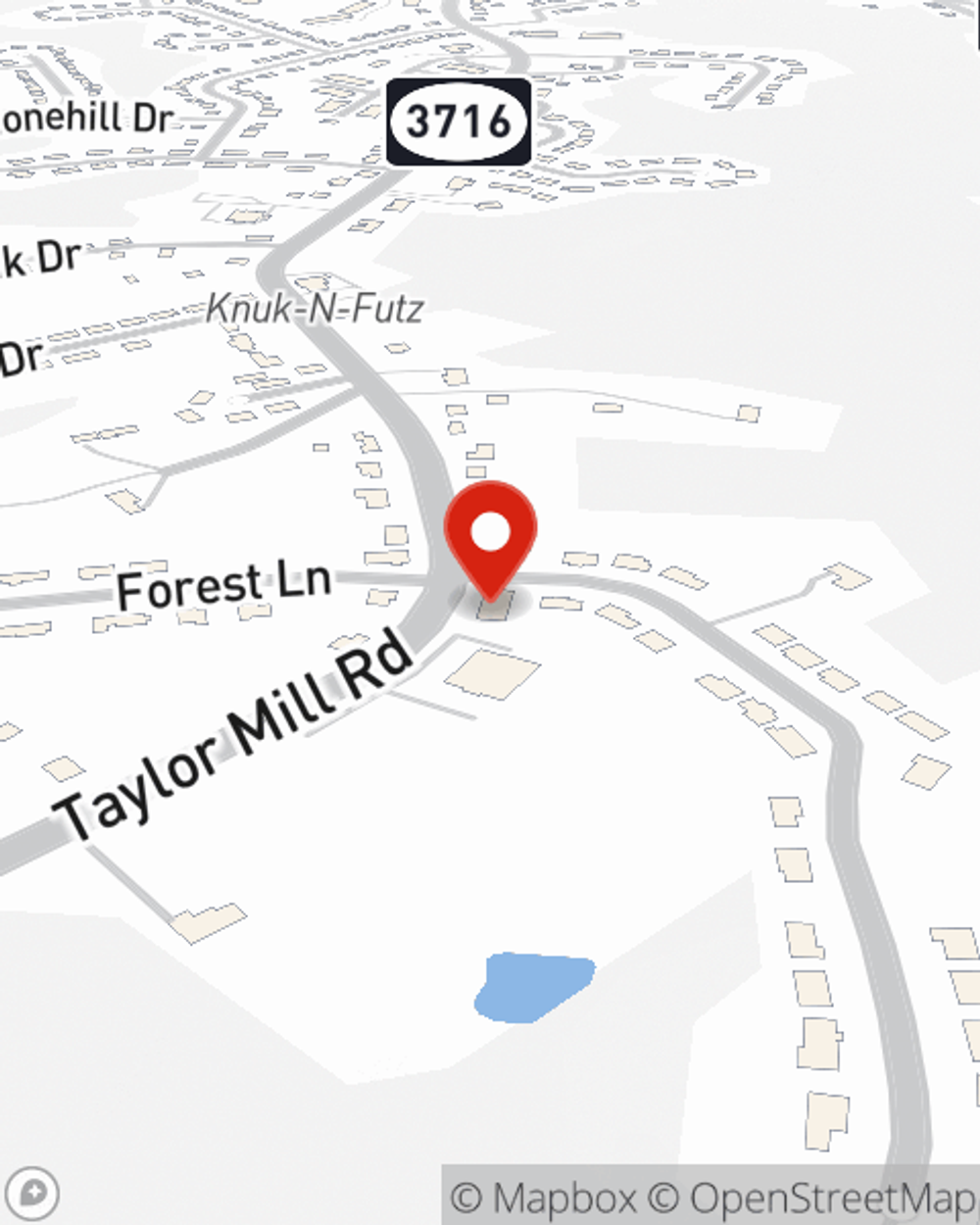

Life Insurance in and around Taylor Mill

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Taylor Mill

- Covington

- Cincinnati

- Florence

- Alexandria

- Louisville

- Lexington

- Newport

- Fort Wright

- Fort Thomas

- Fort Mitchell

- Bellevue

- Edgewood

- Erlanger

- Villa Hills

- Frankfort

- Pikeville

- Georgetown

- Richmond

- Bowling Green

Your Life Insurance Search Is Over

Investing in those you love is what keeps you going every day. You listen to their concerns go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Put Those Worries To Rest

Some of your options with State Farm include coverage for a specific number of years or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Tom Barrick's terrific customer service is what makes Tom Barrick a great asset in helping you choose the right policy.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to discover what a State Farm policy can do for you? Get in touch with State Farm Agent Tom Barrick today.

Have More Questions About Life Insurance?

Call Tom at (859) 360-7396 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Tom Barrick

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.